华为继续占稳RAN市场头把交椅-华为-48v通信高频直流开关电源

华为继续占稳RAN市场头把交椅-华为-48v通信高频直流开关电源

北京时间7月31日消息(艾斯)市场研究公司Dell’Oro Group最近发布的报告显示,全球无线接入网络(RAN)基础设施设备市场(包括2G/3G/4G,不包括家庭small cell)在2018年第一季度同比下降4%,整体RAN市场在2018年预计将下降2%。

2018年第一季度各大厂商市场份额

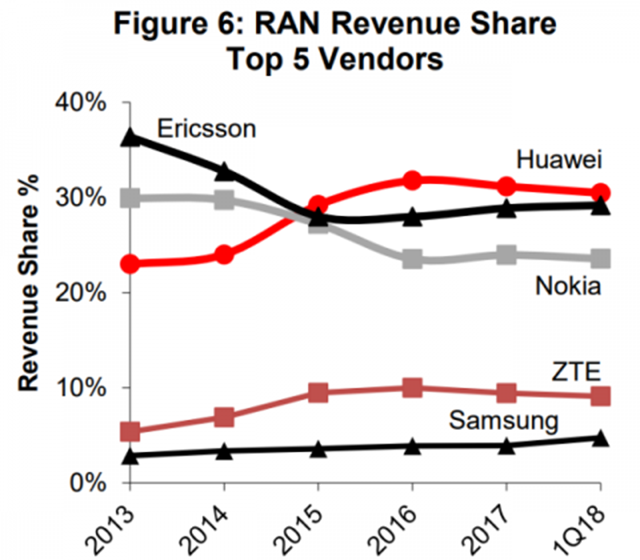

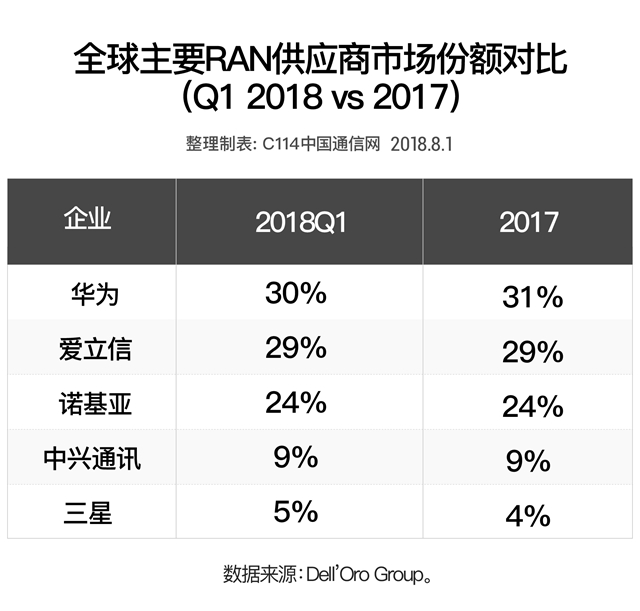

华为的RAN基础设施设备市场份额在2018年第一季度为30%,爱立信的市场份额稳定在29%,诺基亚继续维持在24%,中兴通讯也稳定在9%,三星的市场份额则出现了提升,由4%增至5%。

数据来源:Dell’Oro Group。

华为、爱立信和诺基亚共计占据2018年第一季度全球RAN市场83%的份额,较2017年84%的份额略微下滑。

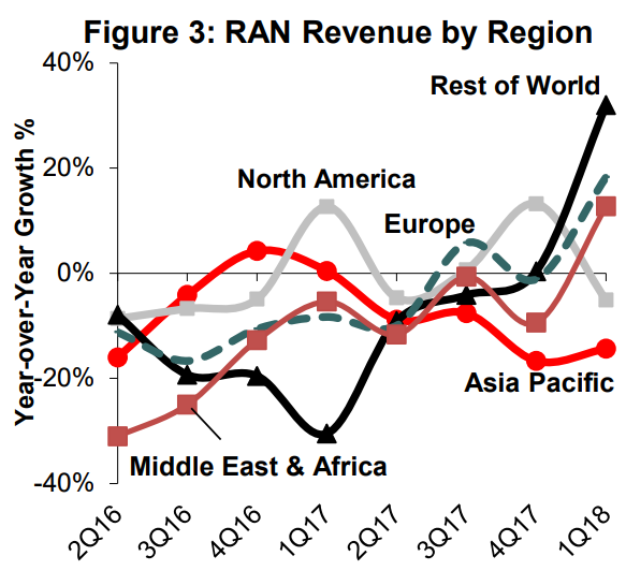

华为今年第一季度占据全球RAN市场30%的份额,相较上年同期呈现稳定性。华为的RAN业务收入在过去两年呈现下滑状态。不过,华为的RAN业务在欧洲和部分亚太地区呈现积极的增长趋势,并且在拉美地区的RAN业务收入增长非常稳定。但是,由于中国市场对移动宽带设备的需求疲软,导致华为RAN业务在中国市场的表现平平。

爱立信RAN业务收入在2018年第一季度呈现同比持平发展。爱立信的RAN业务收入在过去四年呈现下滑状态,并且在中国市场和日本市场表现欠佳。但是北美地区、欧洲、拉美地区、中东和非洲地区推动了爱立信RAN业务收入的增长。爱立信的新无线电平台——Ericsson Radio System (ERS),今年第一季度占据其出货量的84%。

诺基亚的RAN业务收入在2018年第一季度下降了7%,诺基亚RAN业务销售额在2017年下降了4%。诺基亚的RAN业务在欧洲和印度获得了积极的增长,但是在中国和美国市场的表现呈现下滑。

数据来源:Dell’Oro Group。

中兴通讯的RAN收入在第一季度下降了10%,主要是由于中国市场的资本支出下降。

三星的RAN业务收入在第一季度同比下降8%,但是环比呈现增长,而这主要受到美国和印度市场的需求推动。三星正在为Sprint提供Massive MIMO设备,并向Verizon提供了sub 6 GHz宏基站设备。

RAN市场预测

ABI Research发布的一份报告预测,RAN基站设备市场将以5%的年复合增长率增长,在2023年将超过260亿美元。占据这一市场27%的室内设备支出,将以15.5%的年复合增长率增长,到2023年将占据总市场价值的42%。

亚太地区拥有全球最大的和不断增长的RAN市场,该地区将继续占据市场的主导地位,市场份额高达58%,北美地区和欧洲则将分别位列第二、三位。

北美地区和亚太地区的基础设施销售额将继续由更换和升级至LTE为主,此外从2019年开始5G设备份额将会增加。

Acceleran、Airspan、Airvana、康普、京信、Contela、ip. access、Parallel Wireless、Ruckus、Arris、SpiderCloud Wireless和康宁等Small cell公司也将从RAN市场增长中受益。

Beijing time, July 31 (Beijing time) Dell'Oro Group, a market research firm, recently released a report showing that the global wireless access network (RAN) infrastructure market (including 2G/3G/4G, excluding household small cell) fell by 4% in the first quarter of 2008, and the overall RAN market is expected to decline by 2% in 2018.

Market share of major manufacturers in the first quarter of 2018

Huawei's share of the RAN infrastructure market was 30% in the first quarter of 2018, Ericsson's 29%, Nokia's 24%, ZTE's 9%, and Samsung's 5% market share rose from 4%.

Data source: Dell 'Oro Group.

Huawei, Ericsson and Nokia accounted for 83% of the global RAN market in the first quarter of 2018, slightly down from 84% in 2017.

HUAWEI accounted for 30% of the global RAN market in the first quarter of this year, showing stability compared with the same period last year. HUAWEI's RAN business revenue has declined in the past two years. However, Huawei's RAN business is showing a positive growth trend in Europe and parts of the Asia-Pacific region, and its RAN business income growth in Latin America is very stable. However, due to weak demand for mobile broadband devices in the Chinese market, Huawei RAN business in the Chinese market performance is flat.

Ericsson's RAN business income showed a year-on-year growth in the first quarter of 2018. Ericsson's RAN revenue has fallen in the past four years and is underperforming in China and Japan. But North America, Europe, Latin America, the Middle East and Africa are driving Ericsson's RAN revenue growth. Ericsson Radio System (ERS), Ericsson's new radio platform, accounted for 84% of its shipments in the first quarter of this year.

Nokia's RAN business revenue fell 7% in the first quarter of 2018, and Nokia's RAN business sales fell 4% in 2017. Nokia's RAN business has enjoyed positive growth in Europe and India, but its performance in China and the United States has declined.

Data source: Dell 'Oro Group.

ZTE's RAN revenue fell 10% in the first quarter, mainly due to lower capital expenditure in the Chinese market.

Samsung's RAN revenue fell 8% in the first quarter from a year earlier, but it grew year-on-year, driven mainly by demand from the U.S. and Indian markets. Samsung is providing Massive MIMO devices for Sprint, and has provided sub 6 GHz Acer station equipment to Verizon.

RAN market forecast

A report released by ABI Research predicts that the RAN base station equipment market will grow at a compound annual growth rate of 5% and exceed $26 billion by 2023. Interior equipment spending, which accounts for 27% of the market, will grow at a compound annual growth rate of 15.5% and will account for 42% of the total market value by 2023.

The Asia-Pacific region has the largest and growing RAN market in the world. The region will continue to dominate the market with a market share of up to 58%, with North America and Europe ranking second and third respectively.

Infrastructure sales in North America and the Asia-Pacific region will continue to shift from replacement and upgrading to LTE-based, and the share of 5G equipment will increase from 2019.

Small cell companies such as Acceleran, Airspan, Airvana, Compaq, Jingxin, Contela, ip. access, Parallel Wireless, Ruckus, Arris, Spider Cloud Wireless and Corning will also benefit from RAN market growth.

华为继续占稳RAN市场头把交椅-华为-48v通信高频直流开关电源

推荐

-

-

QQ空间

-

新浪微博

-

人人网

-

豆瓣