|

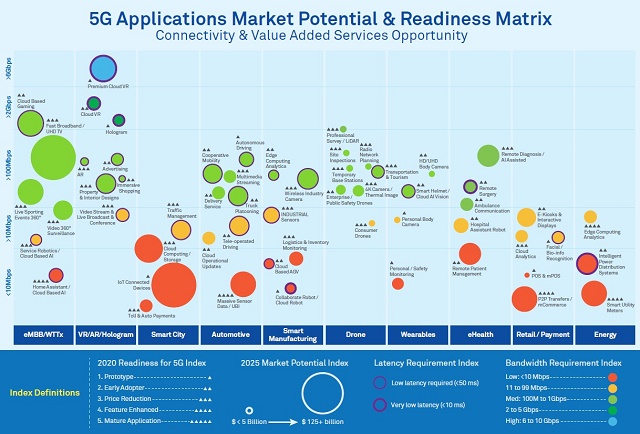

华为做好准备,把握机遇,实现5G变现-华为-48v通信高频直流开关电源华为做好准备,把握机遇,实现5G变现-华为-48v通信高频直流开关电源 当运营商对下一波增长机会的到来翘首以盼,5G已成为电信行业最热门的话题。面对业绩增长的压力,运营商和供应商纷纷"押宝"5G,希望在未来几年内5G能带动新一轮电信投资热潮,使行业重回增长轨道。近期,3GPP标准组织宣布了5G独立组网标准正式出炉,多个国家也启动了5G频谱拍卖,这表明行业正向5G商用迈进。AT&T、Verizon、中国移动和SK电讯等领先运营商已开始与电信设备厂商合作,计划在2018年底前部署5G设备、发布5G智能手机。尽管中国、美国、韩国和日本在5G准备度和早期部署方面领先全球,欧洲和南亚地区国家也不甘示弱,均计划在2020年前启动5G部署,并在其后的三到五年内加速部署并扩大规模。 5G创造新机遇 由于5G具备高带宽、超低时延和动态网络切片能力等特点,运营商不仅能够借此推出众多新业务,还能在数字价值链中扮演新角色。为了抓住5G带来的商机,运营商不得不重新思考自身商业模式,以及未来要以何种方式参与并推动价值的创造、分配和获取。在5G时代,运营商的成功与否将取决于其融入整个价值链的程度。在扮演角色方面,运营商也有更加多样化的选择,他们可以成为网络连接提供商、增强型移动宽带提供商、网络和基础设施服务提供商、平台运营商,或者垂直行业解决方案提供商。为了更好地融入价值链,运营商首先要确定自己将参与价值链上的哪些环节,然后针对相关领域提升能力和效率。 5G最大的市场潜力来自企业业务和物联网 5G的应用场景包括B2C(消费者市场)、B2B(企业市场)、B2B2X(产业生态合作)和物联网市场。面向B2C市场,各大运营商推出了高清视频(电视、电影、赛事直播)和消费者家居安全解决方案等业务。针对B2B市场,运营商为企业(中小型企业和大型企业)提供移动方案和云服务等业务,用户主要是企业员工。在B2B2X市场,运营商的业务包括向体育场馆运营商提供场馆内高清视频服务,场馆运营商再将这种服务提供给他们的VIP客户。这里所说的"VIP客户"主要是指购买赛事贵宾席门票的消费者。通过这种服务,消费者能够用VR或AR设备观看他们错过的精彩瞬间以及了解裁判判罚是否准确。在物联网市场,运营商能够利用5G时延低、可靠性高、带宽高和连接能力强等特点,通过参与各垂直行业生态并创造新的商业模式,为垂直行业提供多种应用场景,例如车联网、智能公用设施和远程手术等。 尽管家居安全和自动化场景所创造的联接大部分来自消费者市场,但物联网服务方面的投入有90%以上是面向企业市场。因此,5G应用的市场潜力将更多来自企业市场和物联网细分市场*(2017年Gartner物联网市场预测)。 5G应用准备度与市场潜力 具有较大市场潜力的5G业务包括超高清电视、物联网设备、智能公用设施、点对点转账或移动商务、远程病患管理、云计算和云存储、活动直播和高级云VR。然而,根据华为无线应用场景实验室(Wireless X Labs)的研究结果,如下图所示,各类业务的部署准备度水平不一。例如,"高级云VR"这样的服务仍处于早期原型机阶段。因此,许多中短期机会在未来2到3年内都无法获得实质进展。

数据来源:华为无线应用场景实验室 5G变现是成功的关键因素 与4G相比,5G网络在覆盖率、信号穿透率以及家庭和企业接入率方面可能并不会产生实质提升,但5G的优势在于带宽更高、容量更大。由于更快速的网络或私有网络需要花费更多,用户在这方面的意愿十分有限,在过去的拨号上网、ADSL上网、有线网络和以太网时代,我们也见到过类似情况。5G有多大的变现潜力,实际更多取决于不同的网络"切片"能支撑多少新的服务和应用,并从中获得收益(例如,光纤数字信道)。 除了网络"切片",运营商还能利用5G的其它独特优势来构建有效的变现模式。以下各种模式值得参考: " 通过网络、基础设施和企业业务变现,即利用网络和基础设施获取收益: o 运营商可以通过向B2B市场提供优质的网络即服务(NaaS)、信息传播、云服务等业务,来吸引高端客户。 o 运营商可以为各类微服务提供边缘计算平台,确保服务低时延。通过这种模式,应用开发商和供应商只需要设定应用的运行方式,实际运行都可交给运营商。 o 运营商可以帮助应用开发商从连接数百万甚至数十亿台设备的应用中获取收益,同时运营商本身也可以从应用开发商和设备的最终用户手中获得收入。 o 运营商还可以利用网络基础设施,通过各种合作与收入共享模式来构建生态,为垂直行业提供解决方案。这种模式成功的关键在于它能帮助运营商和生态系统中的其它参与者将实用的解决方案快速推向市场。 " 通过价值变现:在5G时代,运营商得以将收入共享模式下的服务所创造的价值转化为收益,而不仅仅是通过网络连接服务获得收入。通过由超低时延的边缘网络来承载运算,服务既可以实现云化迁移又不损失低时延特性,运营商通过这种方式,从翻译服务、家居自动化等应用中获得收入。 " 在高清视频内容等新兴数字服务中植入广告,是运营商变现的又一新途径。 " 通过数据变现:运营商的天然优势是能够获取用户数据(如用户喜好和交互数据,以及使用场景、使用规律和海量设备相关数据等)。通过对这些海量数据进行分析,运营商还可以从深度用户洞察中获得收益。 要采用上述各种收入模式,还需要不同的计费模式作为支撑,例如按次计费、会员制计费(经常性收入)、按使用方式计费、基于API计费、预付费模式(使用后才收费)、免费增值模式(基本服务免费,高级服务收费),以及数据流量赞助模式(只要用户使用第三方服务,例如Facebook,基本服务费用就由第三方赞助支付)。 在未来2到5年内,5G网络将加速部署,运营商将有机会扩展业务范围,并融入数字价值链。然而,运营商必须立刻开始行动,随时准备抓住新的机遇,从中获取收益。 提升自身能力,为5G部署做好准备 5G为运营商涉足多个业务领域或行业创造了机会。运营商要审视自身在业务灵活性和运营效率方面是否已为5G部署做好准备。要解决跨异构混合网络虚拟化、现网系统架构复杂、运营与生态建设效率低下等各种复杂问题,运营商还有许多工作要做。 要支撑5G部署,运营商的收入管理系统必须具备切片收费、跨切片关联、超低时延交易实时收费、海量联接和使用事件、生态总计费,以及边缘计费等诸多能力。 运营商的平台必须能支持构建各行业生态系统,同时要能实时按需支持各种复杂的新商业模式,从而获取新的价值。要支撑生态系统和新的商业模式,强大的结算和策略管理系统至关重要。 运营商需要将分析能力、智能化、可执行的洞察力和自动化融入各个业务模块。智能化与自动化将对5G业务的高效运营提供有力支持。 随着云原生市场的发展,运营商必须进行云化转型,通过微服务和基于容器的服务设计和部署原则支撑云原生架构。云原生架构通过敏捷、持续集成/持续交付和开发运营设计流程,支撑数字化业务设计和交付,实现快速上市。在提供运营商级可靠性的前提下,还可按需扩大业务规模来适应动态需求变化。 在强大的网络能力、灵活系统、敏捷运营和新的数字化思维的加持下,运营商在运营效率和成本上的表现将迈上新台阶,这将有力地支撑运营商实现数字化转型。可以说,5G是加速行业数字化转型的催化剂,将全面释放电信运营商的潜力。 结语 面对大好形势,运营商仍需在网络、运营、服务、生态系统和架构等方面切实努力,才能早日兑现承诺,推出5G服务。电信行业应抱持谨慎乐观的态度继续前行,同时要迅速采取积极措施提升自身能力,拥抱5G带来的创收新机遇。华为通信电源,华为电源官网,华为高频开关电源,华为-48v开关电源,华为开关电源模块,华为网络机柜,华为服务器机柜,华为室外一体化机柜,华为OLT电源,华为直流电源,华为开关电源,华为综合柜,华为UPS,UPS5000-E,UPS2000-A,UPS2000-G,UPS8000-D,UPS5000-A,华为TP48200,华为TP48300,华为TP48600 As operators look forward to the next wave of growth opportunities, 5G has become the hottest topic in the telecommunications industry. Facing the pressure of performance growth, operators and suppliers have been "betting" 5G, hoping that in the next few years 5G can lead a new round of telecommunications investment boom, so that the industry back to the track of growth. Recently, 3GPP Standard Organization announced the formal launch of 5G independent networking standards, a number of countries have also started 5G spectrum auction, indicating that the industry is moving towards 5G commercial. Leading operators such as AT&T, Verizon, China Mobile and SK Telecom have begun to work with telecom equipment manufacturers to deploy 5G devices and launch 5G smartphones by the end of 2018. Although China, the United States, South Korea and Japan are leading the world in terms of 5G readiness and early deployment, European and South Asian countries are unwilling to weaken. They all plan to start 5G deployment by 2020 and accelerate deployment and scale-up within the next three to five years. 5G creates new opportunities Because 5G has the characteristics of high bandwidth, ultra-low latency and dynamic network slicing, operators can not only launch many new services, but also play a new role in the digital value chain. In order to seize the business opportunities brought by 5G, operators have to rethink their business model and how they will participate in and promote the creation, distribution and acquisition of value in the future. In the era of 5G, the success of operators will depend on their integration into the whole value chain. Operators also have more diverse choices in terms of their roles as network connection providers, enhanced mobile broadband providers, network and infrastructure service providers, platform operators, or vertical industry solution providers. In order to better integrate into the value chain, operators must first determine which parts of the value chain they will participate in, and then improve their capabilities and efficiency in related areas. 5G's biggest market potential comes from business and Internet of things. 5G application scenarios include B2C (consumer market), B2B (enterprise market), B2B2X (industrial ecological cooperation) and the Internet of Things market. For the B2C market, major operators launched high-definition video (television, movies, live events) and consumer home security solutions business. In the B2B market, operators provide mobile solutions and cloud services for enterprises (small and medium-sized enterprises and large enterprises), and users are mainly enterprise employees. In the B2B2X market, operators'businesses include providing in-venue HD video services to stadium operators, which are then offered to their VIP customers. The "VIP customer" mentioned here mainly refers to the consumers who purchase tickets for the VIP seats. With this service, consumers can use VR or AR devices to watch the wonderful moments they miss and to see if the referee's decision is accurate. In the Internet of Things (IOT) market, operators can take advantage of the characteristics of low 5G delay, high reliability, high bandwidth and strong connectivity to provide a variety of application scenarios for vertical industries, such as vehicle networking, intelligent utilities and remote surgery, by participating in the vertical industry ecology and creating new business models. Although most of the connections created by home security and automation scenarios come from the consumer market, more than 90% of the investment in Internet of Things services is in the corporate market. As a result, the market potential for 5G applications will come more from the enterprise market and the Internet of Things segment * (Gartner Internet of Things Market Forecast 2017). 5G application readiness and market potential 5G services with large market potential include ultra-high definition television, Internet of Things devices, smart utilities, point-to-point transfer or mobile commerce, remote patient management, cloud computing and cloud storage, live broadcast of activities and advanced cloud VR. However, according to the findings of the Wireless X Labs, the deployment readiness levels of various services vary as shown in the following figure. For example, services like advanced cloud VR are still in the early prototype stage. Therefore, many medium and short term opportunities can not achieve substantial progress in the next 2 to 3 years. Source: HUAWEI wireless application scenario Laboratory 5G realisation is the key to success. Compared with 4G, 5G networks may not produce substantial improvements in coverage, signal penetration and home and enterprise access rates, but 5G has the advantage of higher bandwidth and greater capacity. Because faster networks or private networks cost more, users'willingness to do so is limited. We've seen similar things in the past with dial-up, ADSL, wired, and Ethernet. How much of 5G's liquidity potential actually depends more on how many new services and applications different network "slices" can support and benefit from (for example, fiber-optic digital channels). In addition to network slicing, operators can take advantage of other unique advantages of 5G to build effective liquidity models. The following models are worthy of reference: "Through network, infrastructure and business transactions, that is, using network and infrastructure to generate revenue: Operators can attract high-end customers by providing high-quality network as a service (NaaS), information dissemination, cloud services and other services to the B2B market. O operators can provide edge computing platform for all kinds of micro services to ensure low service delay. Through this mode, the application developers and suppliers only need to set the operation mode of the application, the actual operation can be handed over to the operator. O Operators can help application developers make money from applications that connect millions or even billions of devices, and operators themselves can make money from application developers and end users of devices. |